‘Forever chemicals’ legacy weighs on Chemours’ future

By David Schultz & Sylvia Carignan | Bloomberg Environment | November 4, 2019

Read the full article by David Schultz & Sylvia Carignan (Bloomberg Environment)

“Investors are increasingly worried that The Chemours Co. may face an unsustainable burden of environmental liabilities from a class of chemicals found in groundwater aquifers and other sites across the country.

Estimates of Chemours’ liabilities related to the chemicals, known as per- and polyfluoroalkyl substances, or PFAS, range from the company’s figure of up to $802 million, to one analyst’s calculation of more than $160 billion—more than 15 times the company’s highest-ever market capitalization.

Investors, regulators, and the public will get a better sense Nov. 4 of how big Chemours thinks its problems are, when the company releases third-quarter earnings and updates its liability estimates.

‘The problem is nobody knows what this looks like,’ said Christopher Perrella, a chemicals industry analyst with Bloomberg Intelligence. ‘You can get some mind-boggling numbers on this.’ …

PFAS are found in Teflon and Scotchgard, as well as food packaging and firefighting foam. Known as ‘forever chemicals’ because they don’t break down in the environment and accumulate in the body, they have been linked to health problems including higher cholesterol, birth defects, and cancer, according to the Environmental Protection Agency.

Chemical companies have been making PFAS for decades, but the issue has become more prominent over the past few years with more knowledge about the substances’ prevalence and their potential danger. As scientists learn more about the health effects of the chemicals, states have been setting their own stricter PFAS safety levels.

And public awareness of the problem is only expected to grow after this month’s release of the film ‘Dark Waters,’ starring Mark Ruffalo, which highlights PFAS contamination in West Virginia…

Once regulators set binding safety standards, ‘good luck,’ he said. ‘There will be cleanups all over the place.’ …

Chemours was spun off from DuPont de Nemours Inc. in 2015, taking with it DuPont’s performance chemicals business and its PFAS liabilities. Chemours is now suing its former parent, alleging DuPont lied when it estimated the maximum amount of liabilities. Chemours says DuPont did this to make the new company appear solvent, a requirement for spinoffs under Delaware law.

‘It has since become clear that DuPont’s supposedly ‘maximum’ numbers were systematically and spectacularly wrong,’ Chemours’ attorneys write in their initial complaint.

Chemours wants the court to cap how much of its former parent company’s liabilities it would have to cover or, alternatively, force DuPont to pay it nearly $4 billion…

DuPont is standing by its indemnification agreement. Its current involvement with PFAS is ‘extremely limited,’ company spokesman Dan Turner said. Chemours has ‘clear obligations’ to indemnify DuPont for liabilities associated with its performance chemicals business under the companies’ separation agreement, he said…

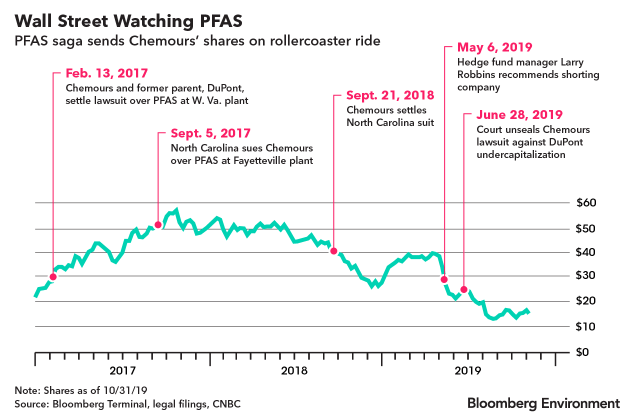

Chemours’ stock price—which had already declined since the beginning of the year—fell 3.8% the day a Delaware court judge unsealed the company’s complaint against DuPont, first filed May 13. Chemours’ shares now trade for four times its previous 12 months of earnings, compared to an average ratio of 25 for specialty chemical companies as a whole, according to data compiled by Bloomberg…

Since the beginning of 2017, President and Chief Executive Officer Mark Vergnano and 10 other top Chemours executives have sold more than 380,000 shares in their company on net, according to data compiled by Bloomberg, although they have been buying some shares in recent months. Vergnano himself purchased 44,000 shares of the company in June, less than a month after the company’s lawsuit against DuPont…

Larry Robbins, founder and CEO of $11 billion hedge fund Glenview Capital Management, told an investing conference in May that he thinks Chemours is ‘facing a liability that we think is worth potentially, substantially, all of its market cap.’ He recommended short-selling the shares.

John Inch, an analyst with the market research firm Gordon Haskett Research Advisors LLC, said last month the company may have to pay out more than $160 billion over the next two to three decades, with roughly half of that coming from environmental remediation, Bloomberg News reported.

New Jersey also has its doubts. In an enforcement case over a former DuPont site in the town of Pompton Lakes, state officials said they’re worried that Chemours may not be able to pay for cleanup because PFAS issues ‘account for a very substantial portion of their environmental liabilities nationwide’ and this ‘directly impacts the company’s solvency,’ the state said in its complaint…

‘There’s so many variables with regard to these particular chemicals,’ he said. ‘Maybe it will just be a lot of legal fees.’

This uncertainty also lets Chemours make very conservative liability estimates. Bruce Pounder, a former senior manager at Ernst & Young LLP who now advises companies on new accounting standards at his firm GAAP Lab LLC, said reporting laws essentially allow companies to go with the lowest possible number when they have liabilities that are difficult to estimate.

‘Management is making up these numbers and making very subjective guesses as to the likelihood of that number,’ he said.

If Chemours’ PFAS costs balloon into the hundreds of billions of dollars, the company will have few options to mitigate this risk. Environmental liability insurance probably isn’t an option for a company of this size, said Christopher Alviggi, senior vice president of the insurer NFP Corp…”

This content provided by the PFAS Project.

Location:

Topics: